Conventional Generation

Conventional generation continues to play a critical role in Europe’s electricity system, even as renewables expand. In a fundamental power market model, these assets provide stability, flexibility, and price-setting functions. The forecasts must carefully capture how conventional generation evolves, accounting for retirements and new investments. While policy ambitions point towards a steady decline, the trajectory varies significantly depending on scenario assumptions.

Thermal Plant Retirement Schedules

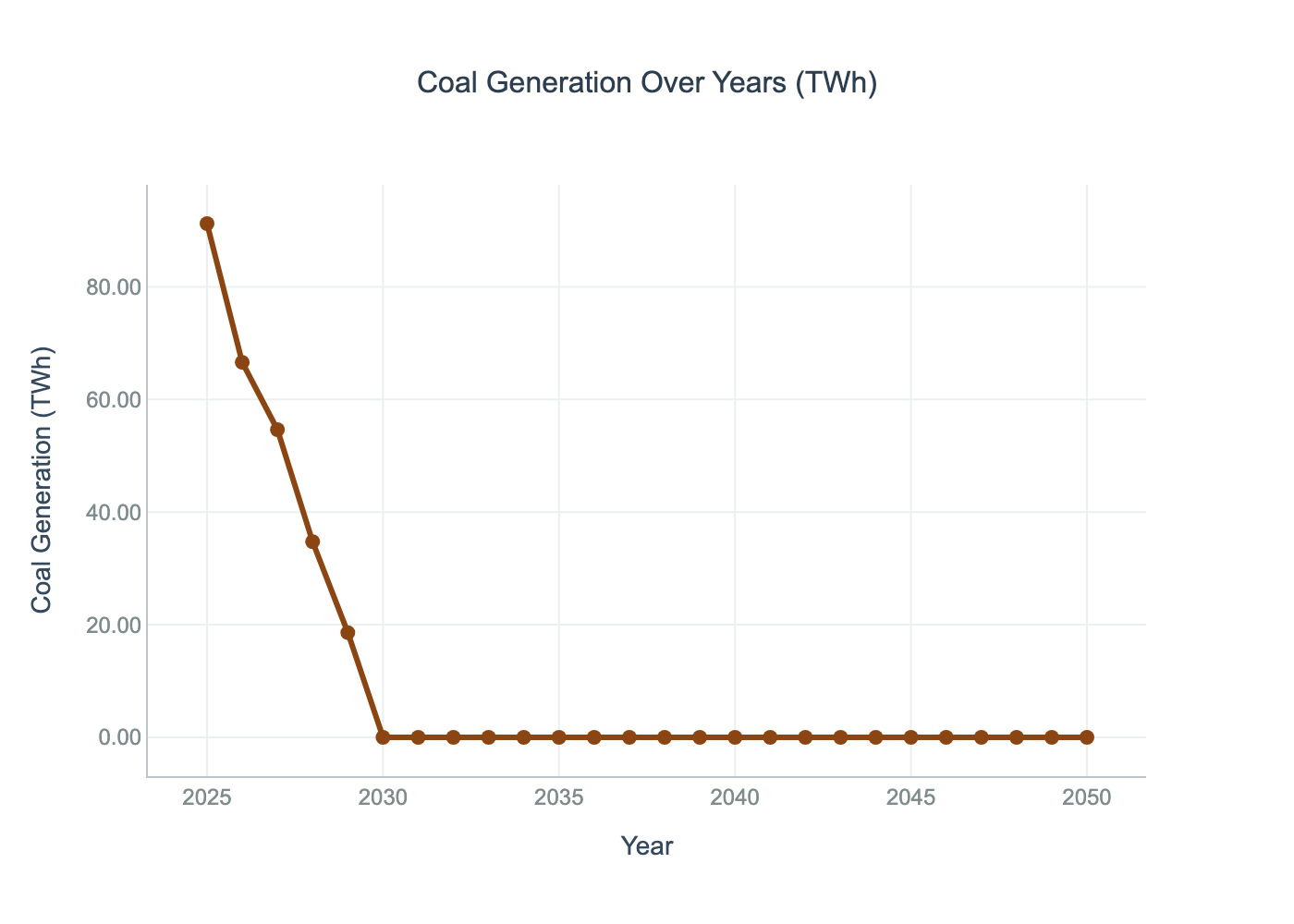

Many coal and older gas-fired power plants are scheduled to retire before 2040. National policies and EU climate legislation drive accelerated phase-outs, particularly for lignite and hard coal. Retirement schedules are therefore a key modeling input. The model reflects published phase-out commitments but also applies assumptions for early closures where plants become uneconomic due to carbon costs.

New Capacity Investments

Despite retirements, new investments in flexible gas capacity continue, particularly in open-cycle gas turbines (OCGTs) and reciprocating engines. These plants provide peaking support during periods of low renewable output. Beyond 2030, some gas units are assumed to be hydrogen-ready or equipped with carbon capture and storage (CCS). Nuclear also plays a role in certain scenarios, with lifetime extensions and new builds reflected in country-specific plans.

Modeling Considerations

Conventional generation forecasts balance three key themes:

- Decarbonization policies, which drive retirements and fuel-switching.

- Security of supply, requiring flexible backup to variable renewables.

- Market dynamics, shaped by commodity prices and carbon costs.

The charts above serve only as illustrative examples. Details around the latest available long term forecast pathways are provided on the Forecast Scenarios page.