Re-Twin Methodology

At Re-Twin Energy, we publish our full methodology because transparency is essential for trust. This section explains how we forecast prices, model storage assets, and simulate trading strategies.

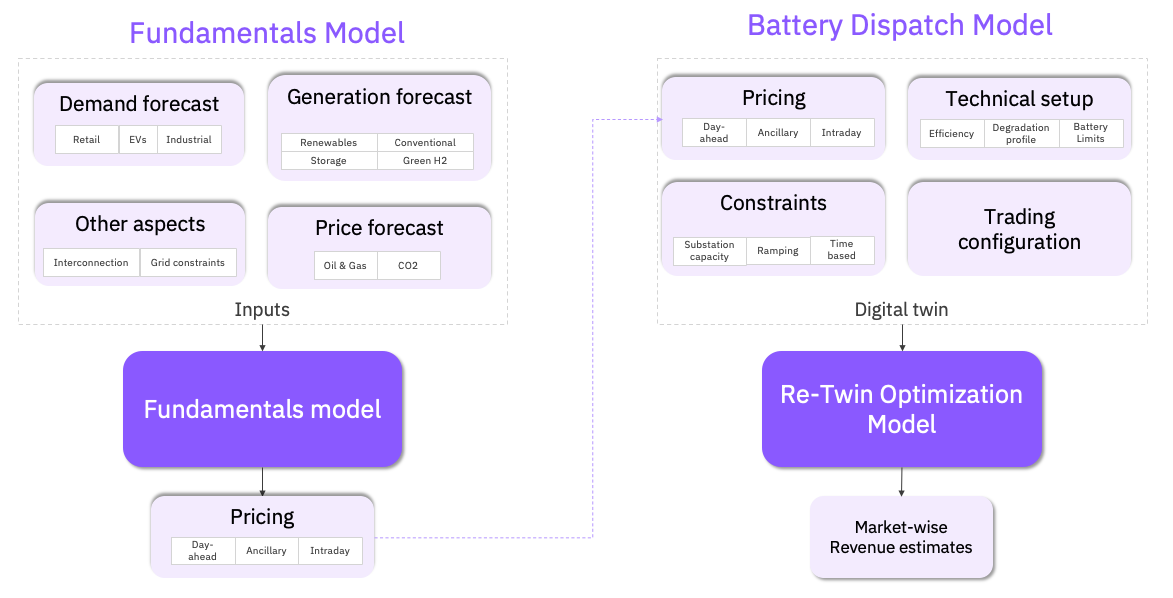

On a high-level, the Re-Twin’s modeling framework links the Fundamentals Model with the Battery Dispatch Model to deliver realistic market-wise revenue estimates for energy storage systems.

As shown in above figure on the left, the Fundamentals Model combines key market drivers. It integrates demand forecasts (retail, EVs, industrial), generation forecasts (renewables, conventional power, storage, and green hydrogen), and price forecasts (oil, gas, CO₂). It also accounts for grid aspects such as interconnections and constraints. Together, these inputs produce pricing outputs for the day-ahead, intraday, and ancillary service markets.

On the right, the Battery Dispatch Model applies these prices to the operational reality of a battery. It considers the technical setup (efficiency, degradation, battery limits), constraints (substation capacity, ramping rules, and time-based limits), and trading configurations. These factors create a digital twin of the battery, ensuring that simulated results reflect practical operation.

Finally, the Re-Twin Optimization Model merges both sides. It uses pricing from the fundamentals model and applies asset-specific characteristics from the dispatch model to simulate real trading behavior. The outcome is robust revenue estimates across markets, giving developers and investors a transparent view of how a battery can generate value under different market conditions.

Methodology breakdown

Our approach is structured into five layers which are described in the next sections:

- Fundamentals Model → long-term market forecasts (demand, renewables, commodities, capacity expansion, price formation)

- Storage Dispatch Modeling → optimal operation of batteries under market and asset constraints with the ability to select trader-like strategies

- Co-location & Trading Layer → hybrid assets, shared grid limits and shared optimization

- Calibration & Backtesting → benchmarking against real-world data to ensure reliability

- Data Sources → Transparent and auditable datasets that underpin all our models, ensuring consistency and reliability.