Index Methodology

Revenue Optimization for Battery Energy Storage Systems (BESS)

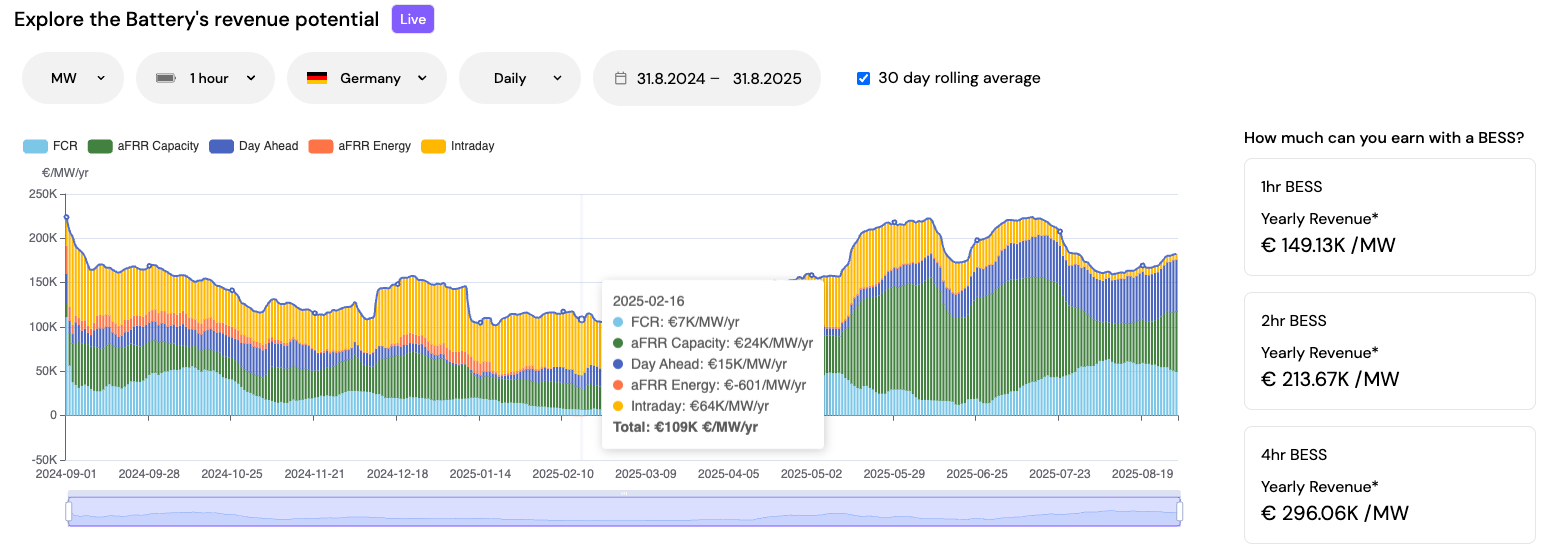

Our methodology provides a comprehensive approach to estimating revenue opportunities for Battery Energy Storage Systems (BESS). It evaluates how revenue potentials evolve over time and considers the impact of participating in multiple power markets simultaneously. The model is designed to optimize market participation strategies over a defined timeframe, offering actionable insights for investors and operators.

The calculations are based on imperfect hindsight, where randomness is introduced to the perfect hindsight prices by adding a standard deviation of 10%, reflecting actual market conditions during the analyzed period. To further counter the advantages of perfect hindsight, a conservative approach is taken for each market where the BESS participates. Up to 80% of its power rating is allocated to ancillary markets, while the remaining capacity is used for trading in energy markets.

While this analysis offers a preview of our model's capabilities as a demo case, our investment analysis tool supports more detailed modeling, including different bidding strategies and selecting market-participation.

Due to constraints in publicly available data, certain assumptions and simplifications are applied.

Key Assumptions and Parameters

The following parameters are integral to our methodology:

- Battery size: 10 MW/10 MWh (1-hr), 10 MW/20 MWh (2-hr) and 10 MW/40 MWh (4-hr).

- Geography: Germany, Austria, Belgium (additional regions will be included in future versions).

- Roundtrip efficiency: 90.25% (95% efficiency for both charging and discharging).

- Daily cycle limit: 2 cycles/day.

- State of charge (SoC): Managed as a rolling variable based on prior day activities, without reset.

- Min/Max SoC limits: 10% (minimum) and 90% (maximum).

- Asset degradation: Not included in this demonstration (available in the investment analysis tool).

- Market behavior assumption: BESS is treated as a price-taker, submitting bids based on internal costs, constraints, and strategies with the market prices not being influenced.

Market Approach and Assumptions

In our approach, the revenues from the ancillary markets are combined with trading revenues from the wholesale market. For trading on the wholesale market, it is assumed that trading first takes place on the day-ahead market and then, taking into account the results from the day-ahead market, the remaining capacity is offered on the aFRR Energy markets. The revenues from intraday markets (auction and continuous) will be added in the future versions.

Our model integrates revenues from ancillary services and wholesale markets, combining:

- Capacity Markets: Up to 80% of the battery's capacity is allocated to these markets (FCR, aFRR Positive and aFRR Negative Capacity) to guarantee certain revenues from the ancillary markets. Participation in mFRR Capacity markets (Positive and Negative) is assumed to be not available.

- Energy Markets: Remaining capacity is allocated to trading in the day-ahead (DA) and aFRR Energy Positive and Negative markets. The decision on participation in these markets is through optimization.

Market-Specific Constraints and Strategies

The calculations are based on imperfect hindsight, where randomness is introduced to the perfect hindsight prices by adding a standard deviation of 10%, reflecting actual market conditions during the analyzed period. To further counter the advantages of perfect hindsight, a conservative approach is taken for each market where the BESS participates. Up to 80% of its power rating is allocated to ancillary markets, while the remaining capacity is used for trading in energy markets.

- Day-Ahead and Intraday Trading

- The power limit (Pmax) and state-of-charge limits (10-90%) of the battery must not be exceeded.

- Frequency Containment Reserve (FCR)

- Maximum marketable capacity is reduced by 20% to align with pre-qualification (PQ) standards. We assume that the marketable power is reserved for 30 mins delivery. It is assumed that no power is lost or gained when participating in FCR.

- Automatic Frequency Restoration Reserve Capacity (aFRR Capacity)

- Maximum marketable capacity is reduced by 20% according to the pre-qualification (PQ) conditions. We assume that the marketable power is reserved for 1h delivery. It is assumed that no power is lost or gained when participating in aFRR capacity markets and therefore the bids are assumed to be highest to avoid dispatching.

- Automatic Frequency Restoration Reserve Energy (aFRR Energy)

- Given aFRR Energy dispatch has higher uncertainity than Day Ahead, Positive (aFRR_POS Energy) bid prices are set at 50% above day-ahead prices, while negative (aFRR_NEG) bid prices are set 50% below day-ahead prices. Since day ahead results are available, the bid prices for this market can be based on the day ahead prices. Given fixed price, our model decides the volume to be bid depending on the revenues from the market.

Optimizing Bids Across Multiple Power Markets: A Baseline Strategy

The baseline strategy applied here aims to optimize bids across various power markets, including ancillary services (FCR, aFRR, mFRR) and energy markets (day-ahead and aFRR energy) with the goal of maximizing revenues. We leverage a sequential approach to generate, submit, and evaluate bids, ensuring that decisions are progressively informed by prior results. The following steps outline the core methodology:

- Preliminary Optimization for Ancillary Capacity and Day-Ahead Markets

A preliminary optimization is performed for ancillary services and day-ahead market, taking a conservative approach of winning bids (upto 80% of the power capacity of the BESS) in these markets, making sure minimum revenues are achieved. - Sequential Market-Specific Bid Generation and Evaluation Based on the preliminary optimization, market-specific bids are generated and evaluated within its unique context (e.g. FCR is pay as cleared market while aFRR capacity is pay as bid market). If bids are won then the conditions necessary for that market are maintained in the other markets going forward. The ancillary capacity markets are prioritized, followed by the day-ahead and other energy markets.

Key Strategy Components:

- Sequential Approach: The optimization process follows a step-by-step approach, starting with ancillary services and progressing through the day-ahead and intraday markets.

- Bid Feedback Loop: The results from each market optimization are used as feedback, informing subsequent optimization runs. This iterative approach is used to refine decisions and maintain alignment with changing market conditions.

- Conservative Design: The strategy takes a conservative approach by fixing ancillary market results before revisiting energy market bids. The approach accounts for market-specific constraints and priorities.